Required Minimum Distributions, 401(k) Contributions & 529 Rollovers

Legislation passed in late 2022, the SECURE Act 2.0, provided funding for the Federal government through September 30, 2023, and made some significant retirement-related changes. In this article, we’ll review three items that may affect you.

1. How the SECURE Act 2.0 Affects Required Minimum Distributions

The act applies to retirees who have tax-deferred retirement accounts, like a 401(k) plan, 403(b) plan, traditional IRA account, or IRA Rollover account. Starting in 2023, the age at which required minimum distributions (RMD) must start has been increased from age 72 to age 73. By 2033, the starting RMD age will be raised to 75.

As a reminder, any tax-deferred retirement account owner over the age of 59½ can begin to make withdrawals from their account without penalty. There is no need to wait until RMD’s are required to make withdrawals, but retirees with other income sources sometimes choose to wait.

How Does the RMD Work?

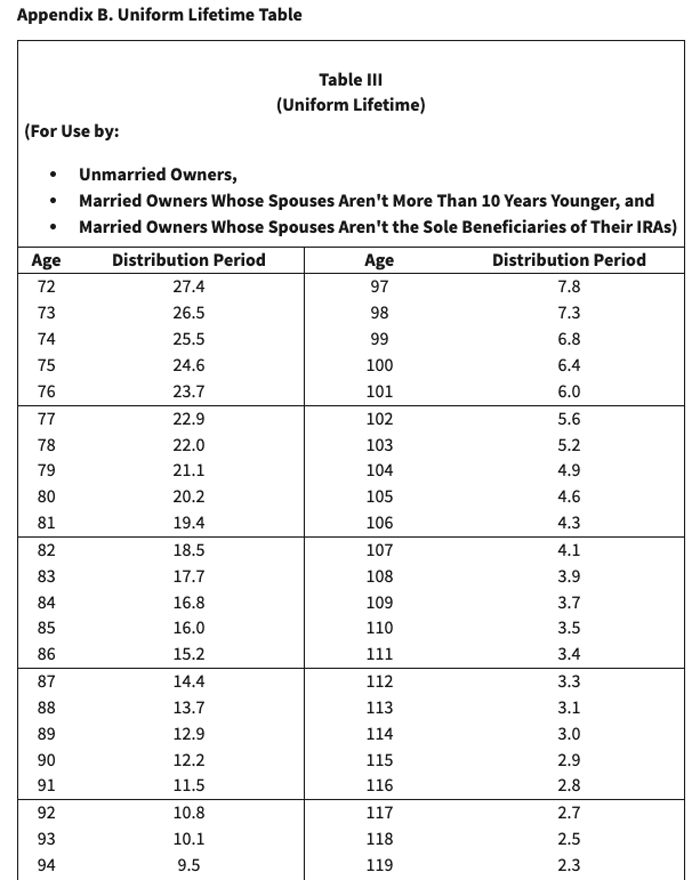

Start by identifying your required start age, and then pull up the IRS Uniform Lifetime Table applicable to your situation (for the Tables, scroll to Appendix B, near the very bottom of the IRS pages linked).

Sometimes, an example is the best explanation:

- If your age at the end of 2023 is 72, and your spouse is less than 10 years younger than you, look at Table III (Uniform Lifetime).

- Locate your age

- Locate the “Distribution Period” next to your age. This will be your divisor number. In the 2023 Table III (Uniform Lifetime), the divisor for age 72 is 27.4.

- Continuing with our example, assume your IRA balance at the end of the previous calendar year (as of 12/31/2022) was $1,000,000. In this example, your required distribution is $36,496.35 ($1 million divided by 27.4)

As your age increases each year, the divisor number in each Table gets a little smaller. The smaller the divisor number, the bigger the distribution requirement.

How Does the SECURE Act 2.0 Affect Withdrawals?

As the age required to start tax-deferred withdrawals increases, investors may be concerned that the additional years of growth prior to the first RMD may increase the required withdrawal amount each year. That is possible, however, the IRS Uniform Lifetime tables and RMD divisor numbers have also been updated (depending on marital status and spousal age, scroll to Appendix B Table II or Table III of the IRS Uniform Lifetime Table).

2. Thanks to the SECURE Act 2.0, Employees Between 60-63 Can Now Invest More

Another change made in the SECURE Act 2.0 helps workers between the ages of 60-63 to save an additional 50% above the “catch-up” amount allowed in a particular year.

For instance, if the “catch-up” savings allowance is $7,500 (the 2023 catch-up allowance), employees between ages 60-63 may save an additional $3,750 on top of the extra $7,500 catch-up and the base limit of $22,500 into their 401(k) or 403(b) type retirement plan for a total of $33,750 in 2023.

3. The SECURE Act 2.0 Allows Beneficiaries to Rollover Unused 529 College Savings Plan Balances

Another SECURE Act 2.0 change allows some 529 college savings plan balances to be “rolled” into a Roth IRA account of the 529 plan beneficiary. The provision allows for a lifetime maximum of $35,000 from a 529 plan in existence for at least 15 years to be converted into a Roth IRA. Conversions are limited to the annual Roth IRA contribution limit, so fully converting the $35,000 lifetime limit would take several years.

There are several other significant provisions in the SECURE Act 2.0. Schwab has a good overview of them here.

For more advice from the financial advisors of Schmitt Wealth Advisers, view Our Outlook blog. Want to start a conversation about your financial future? contact us.

This material is provided by Schmitt Wealth Advisers, LLC for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment product. Opinions expressed by Schmitt Wealth Advisers are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Schmitt Wealth Advisers, however, cannot guarantee the accuracy or completeness of such information. Past performance may not be indicative of future results.