Global supply chain issues are both a supply and a demand problem.

On the supply side, labor has become scarce. Pandemic related mandatory shutdowns, COVID quarantines, and older worker retirement decisions have combined to create a serious labor shortage.

In the October National Association of Business Economics (NABE) survey, 47% of respondents reported a shortage of skilled labor. This is a striking increase from the 32% who reported the same issue as recently as July.

On the demand side, consumers were essentially forced to shut-in which significantly impacted service businesses like restaurants, hotels, airlines and cruise ships. As a result, money normally spent on services was either saved or redirected toward purchasing goods.

Even as the economy has reopened and service businesses came back, the strong demand for goods has continued. This increased demand for goods has manifested in shortages and backorders for many types of consumer goods.

Exacerbating the problem is the containership backlog. Our research finds that the current containership backups at the ports of Los Angeles and Long Beach are being caused by increased volume in both imports and exports (throughput).

For instance, through September 2021, combined TEU throughput (industry standard Twenty Foot Equivalent containers) over the past twelve months is 20,427,440. This compares to the pre-pandemic 5-year average (2015-2019) of 16,478,322; a 23.9% increase.

The fact that TEU throughput between these two ports has increased over 20% and still cannot keep pace with the new containership arrivals, shows how much demand for goods has skyrocketed.

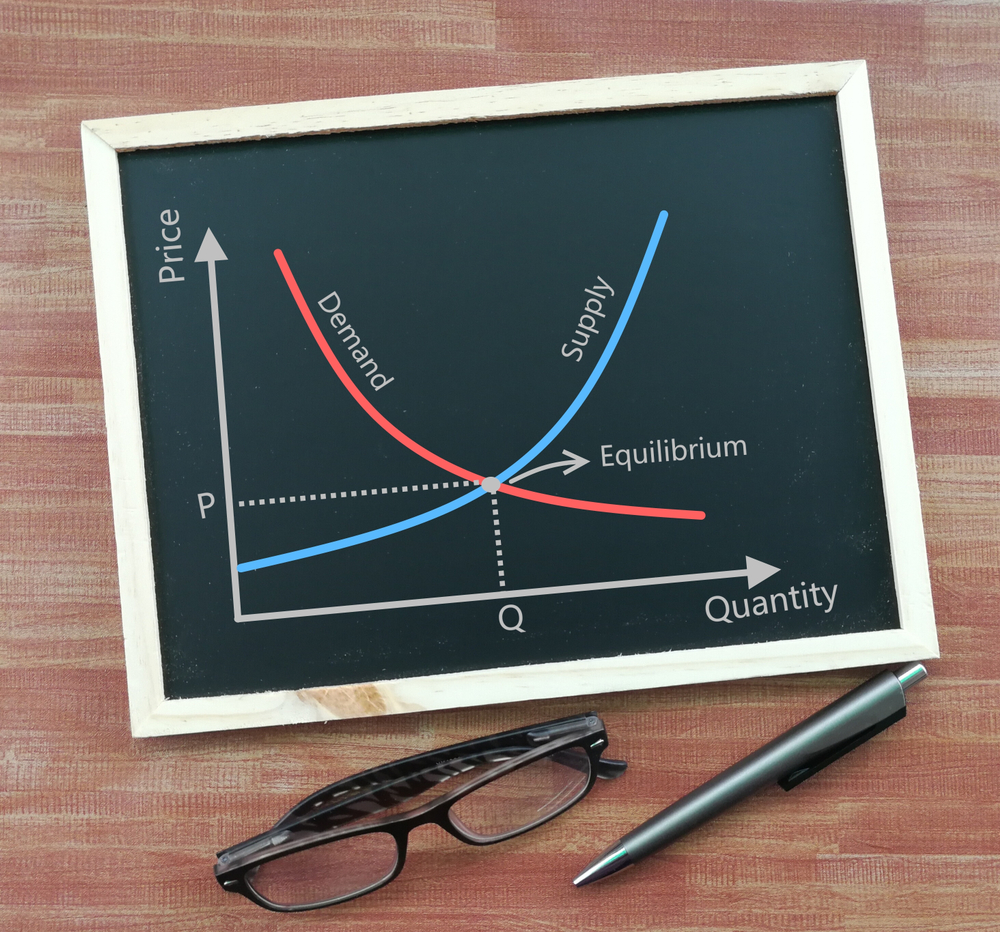

This imbalance will likely end as many others have ended; in recession. In free economies, supply and demand dictate price. If supply outstrips demand, prices fall. Conversely, if demand outstrips supply, scarcity forces prices to rise.

A common response to scarcity is the capitalist urge to grow by increasing capacity. When business is good and demand is strong, many businesses decide to increase capacity at the same time. This buildout contributes to the ongoing boom for a while, however, as the new capacity comes into the market, supply eventually catches and often overtakes demand leading to price declines and eventually to recession.

The resulting overcapacity is corrected by bankruptcies, mergers, and layoffs until balance is once again restored. The business cycle continues.

Disclaimer

This material is provided by Schmitt Wealth Advisers for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Opinions expressed by Schmitt Wealth Advisers are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from publicly available sources (unless otherwise noted) and are believed to be reliable. Schmitt Wealth Advisers, however, cannot guarantee the accuracy or completeness of such information. Past performance may not be indicative of future results.