As You Near Retirement, It’s Time to Get Serious about Planning

Are you considering retiring within the next five to 10 years? If so, retirement calculators you find online may leave you with more questions than answers. Schmitt Wealth Advisers can help you prepare a Goal Plan and work towards achieving it.

A Retirement Calculator Misses Many Factors

The simplistic calculations of a retirement calculator don’t account for personal situations like retiring early, health concerns and legacy.

Refining your Goal Plan typically starts to happen as your desired retirement age gets to be about 10 years away. You’ll want clarity on these important questions:

- How much will you need to have accumulated to retire comfortably?

- How should you think about your desired income goal in retirement?

- How do healthcare expenses impact your plan if you retire before age 65?

- How does Medicare part B and part D, and deductibles factor in after age 65?

- What is the optimal way for you, or you and your spouse, to take your Social Security benefits?

These are questions that can be answered by preparing a retirement plan analysis with the help of a trained and experienced professional advisor who gets to know you and your personal needs.

A Retirement Calculator is the Newest “Rule of Thumb” Shortcut

The online retirement calculator is the latest tool that tries to make retirement planning one-size-fits-all. Another popular shortcut in the 1990’s was to pick an accumulated savings number or goal amount and apply the prevailing bank certificate of deposit (CD) interest rates to the number. For instance, $2 million in savings invested into a 5% CD would generate an “income” of $100,000 annually. While that approach seemed like it should work, there were two pitfalls.

- Bank rates change regularly, and in the past two decades, have been little more than 1% or 2%, until recently.

- This back-of-the-envelope type calculation does not consider the impact of inflation. Consider the fact that as little as 2.5% annual inflation compounded over 20 years cuts the buying power of $100,000 to just over $60,000. That represents a 40% decline in lifestyle. Inflation is real, and you have to plan for an ever-rising income over your lifetime.

A Personalized Goal Plan Gives You Confidence about Retirement Decisions

Today, the cutting-edge, professionally-prepared Goal Plan analysis we create for clients builds in multiple goals and assumptions around your baseline living expenses. It goes far beyond a retirement calculator. Analysis includes income growth to offset inflation assumptions, healthcare cost assumptions, (pre-Medicare and post Medicare), and the ability to model multiple secondary goals/expenses like education, weddings, home remodeling, charitable gifts, and annual travel plans.

One of the most powerful features in cutting-edge Goal Planning analysis is the use of simulation testing and modeling. There are certain variables in a goal plan analysis that change frequently and are generally unpredictable. Interest rates change, stock market prices and performance returns change and can vary significantly from year to year, and bond market rates change and returns vary over time. (Meanwhile, a typical retirement calculator asks you to assume a constant rate of return on all your savings).

How Powerful Planning Tools Excel a Retirement Calculator in Every Way

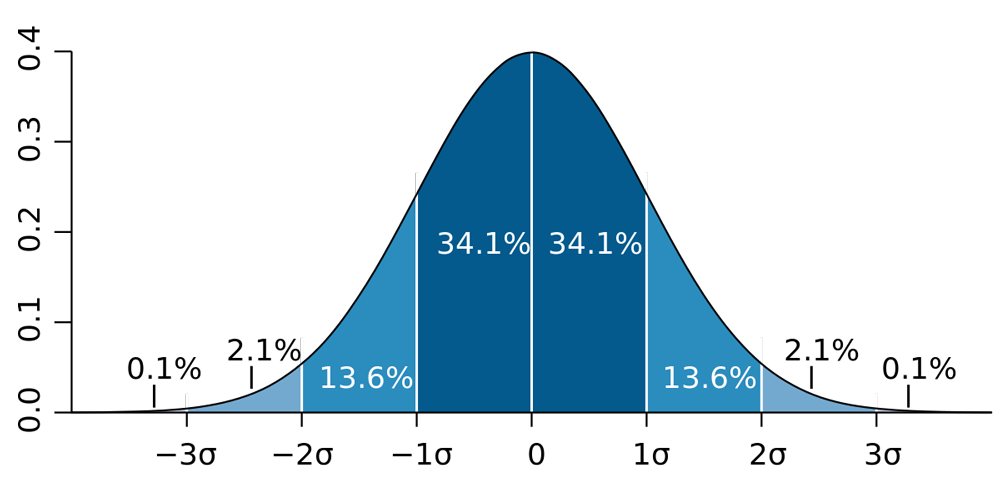

The most powerful planning tools simulate these changes by using thousands of randomized performance return calculations for each asset class in a client’s investment allocation. The simulated returns can occur above or below three standard deviations from the mean (average). What does standard deviation tell you about investing?

- 1 standard deviation shows the range of returns you can expect to see 65% of the time (think of it as 65 out of 100 years). The formula equals the average return (the mean), plus or minus the variance (1x the standard deviation).

- 2 standard deviations show the range of returns you can expect to see 95% of the time (think of it as 95 out of 100 years). The formula equals the average return (the mean), plus or minus 2x the variance (2x the standard deviation).

- 3 standard deviations show the range of returns you can expect to see 99% of the time (think of it as 99 out of 100 years). The formula equals the average return (the mean), plus or minus 3x the variance (3x the standard deviation).

- Looked at in reverse, the occurrence of an event more than 2 standard deviations from the mean (average) is expected to occur less than 5% of the time (think of it as up to 5 out of 100 years).

For example, an asset class that has a mean return of 10% and a standard deviation of 20% would vary between -10% and +30% and would occur 65% of the time.

A three standard deviation event (or worse) would be expected to occur less than 2% of the time, and the range in our example could deliver a return as low as -50% or more or as good as +70% or more. Your planning analysis should allow for these outliers or black swan type events. In the last 100 years, they have occurred several times: 1929-1932, 2001-2003, 2008-2009.

When Planning for Retirement, there are Numerous Combinations of Variables … and You Need a Plan that Can Test for Hundreds of the Possible Outcomes to Determine a Realistic Probability of Success.

Looking at your retirement goals with randomized rates of return for each asset in your investment portfolio is critically important. In real life, returns vary from year-to-year. Comparing two “lifespans” with the exact same inputs, the exact same assumptions, and the exact same average return rate can produce drastically different results depending on the sequence of returns. This is due to the natural randomness or sequence of how the returns happen in real life.

In conclusion, if you are five to 10 years from your desired retirement, don’t rely on a retirement calculator that gives you a back-of-the-envelope estimate. If you do not yet have a professional Retirement Goal Plan analysis, consider it now. Schmitt Wealth Advisers has over 30 years of experience and CFP© (certified financial planner) staff using state-of-the-art planning tools. We’ll help you prepare your retirement goal analysis today and help you stay focused on your goals going forward. Download our :7 Essential Steps to Make Your Retirement Decisions Easy” report to learn more.

For more investing insights from Schmitt Wealth Advisers, view Our Outlook blog. Want to start a conversation about your financial future? Contact us.

This material is provided by Schmitt Wealth Advisers, LLC for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy, or investment product. Opinions expressed by Schmitt Wealth Advisers are based on economic or market conditions at the time this material was written. Economies and markets fluctuate. Actual economic or market events may turn out differently than anticipated. Facts presented have been obtained from sources believed to be reliable. Schmitt Wealth Advisers, however, cannot guarantee the accuracy or completeness of such information. Past performance may not be indicative of future results.