A Look at Tax Increase Proposals

As the 2020 presidential election nears, members of congress and other potential 2020 candidates have begun testing new political positions aimed at gaining approval with targeted voter demographics. Two such proposals are a proposed 3% wealth tax and a proposed 70% marginal income tax rate.

The United States of America has a progressive income tax system. This means that as your income goes up, you pay higher and higher tax rates on each marginal dollar of income.

For example, under tax changes started in 2018, single earners pay at the 10% marginal federal income tax on earnings below $9,700. After applying the $12,900 standard deduction, that same individual likely pays no income tax. For a couple filing jointly, the 10% marginal federal tax threshold is $19,400 of earnings, and the standard deduction for the couple rises to $24,400 – again likely reducing tax owed to zero. High income earners (single filers) pay 37% federal income tax on income earnings over $510,000 (adjusted gross income or AGI). Similarly, a married couple filing jointly pays at the top 37% marginal rate on income earned over $612,315.

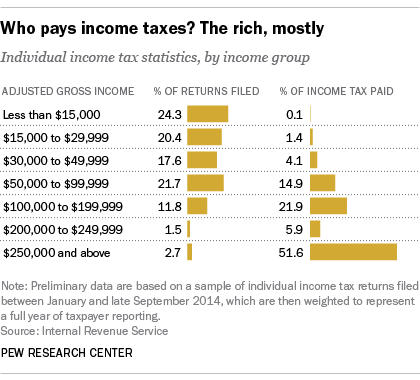

According to a Pew Research study, 47.4% of all federal taxes are collected from individual households. Looking further at federal tax receipts from households, the bottom 62.3% of earners pay a 5.6% slice and the top 2.7% of earners pay a 51.6% slice of federal income taxes collected from individuals. Include households with income over $100,000, and the top 16% of earners pay 79.4% of all federal income taxes collected from households.

Despite evidence like this that our progressive tax system works well, politicians choose narratives that suggest higher income earners do not pay their ‘fair share’. Recently, a politician from the high tax state of Massachusetts, proposed a 3% annual tax on a household’s accumulated wealth. This proposal may make for a good sound bite, but how well would it work if enacted? Linked here is one possible outcome based on Jeff Bezos, Amazon’s founder and the wealthiest man in America.

Another politician, from the high tax state of New York, proposed raising the top marginal tax rate to 70%. Maybe this works well as a sound bite or campaign trail theme, but this politician need look no further than her own state to see that expectations of higher revenue may not pan out as planned (New York state recently announced a $2.3 billion revenue short-fall here).

The current debate around immigration is a good reminder that citizens of other nations still look to America as the beacon of freedom and opportunity in the world. What if politicians successfully change laws to make the wealthiest American’s pay more taxes? To avoid taxes, some will likely use legal loopholes politicians provide for their wealthy donors, and, assuming America remains a free republic, some will do what New Yorkers are doing and simply leave.